If you’ve been following Taos real estate news, 2025 probably felt quieter than the years before it. Fewer dramatic headlines. Less urgency. More patience on both sides of the table.

That doesn’t mean the Taos real estate market slowed down. It means it settled into something closer to normal.

This 2025 year-end report looks at what actually happened across the market, how it compares to 2024, and what the early signals suggest as we head into 2026. While this is a backward-looking report, I’ll also share a brief outlook at the end based on current inventory, buyer behavior, and broader trends influencing Taos, New Mexico.

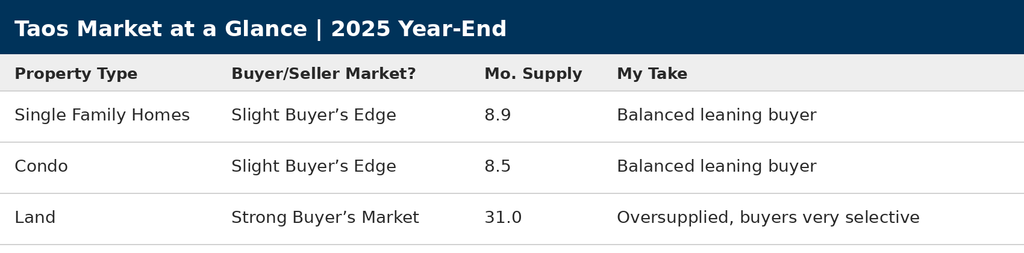

Taos Market at a Glance

Click to Enlarge | Months of Supply for homes, condos, and land. Based on a six-month average of monthly home sales.

The Taos market shows a slight buyer’s edge for homes and condos, with about nine months of supply, while land remains firmly buyer-favored due to elevated inventory. Buyers are active but selective, and properties that are priced correctly, well marketed, and truly turn-key continue to sell faster than the broader averages. Location matters, with homes and condos in high-demand areas like the Town of Taos and near the Historic Taos Plaza consistently outperforming the rest of the market.

John’s Take

“When price, condition, and marketing are aligned, especially in high-demand areas, properties can still outperform the market. When they’re not, buyers move on quickly. This market rewards precision.”

History of Home Prices in Taos

While the overall median price rose noticeably from 2024 to 2025, this figure was influenced by a higher share of sales in the $1M+ segment. When focusing on the under-$1M market, where most buyers transact, the median price increased more modestly, reflecting steady but not dramatic appreciation.

Mid-year data showed a modest softening in prices, and the full 2025 numbers confirm this was a temporary adjustment, not a sustained decline. Prices moved lower as inventory increased and buyers became more selective, but stabilized and recovered by year-end.

2025 Quarterly Median Sale Prices (Single-Family Homes):

Q1: $615,000

Q2: $608,750

Q3: $566,500

Q4: $601,500

The mid-year dip continued into Q3, reflecting slower seasonal activity and reduced urgency, before rebounding in Q4. This pattern suggests the market spent much of 2025 recalibrating rather than correcting, with pricing remaining resilient despite a shift toward buyer leverage.

John’s Take

“2025 was about normalization, not falling values. Prices adjusted as inventory grew and buyers gained leverage, but the rebound in the fourth quarter shows there’s still a solid floor under the market. Well-priced homes didn’t lose value, they just had to meet the market more precisely.”

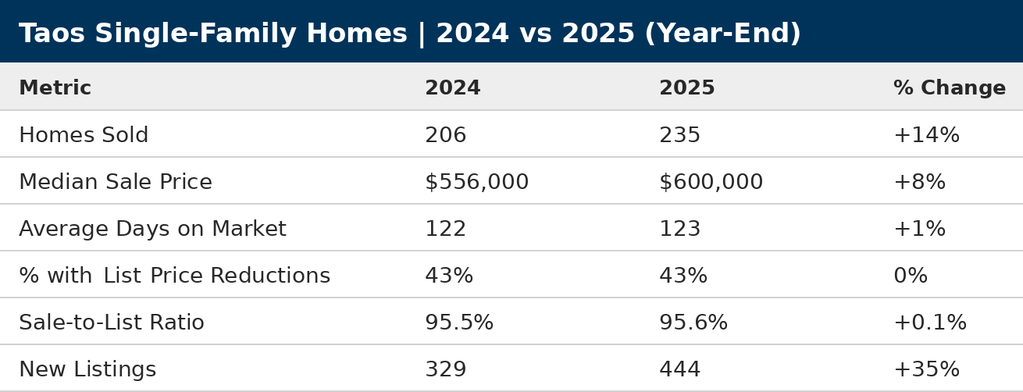

Single-Family Homes: 2024 vs 2025

Single-family home activity increased in 2025, even as significantly more inventory entered the market. More homes sold, more listings were added, and buyers had a greater choice without forcing widespread discounting.

The share of homes with price reductions stayed essentially flat year over year, showing that almost half of sellers had to reduce their listing price before going under contract.

Overall, 2025 reflects a market that stabilized with steady activity and broader buyer choice. Buyer leverage came from options and timing, not from falling values.

John’s Take

“Buyers gained choices in 2025, not bargaining power. Homes that were priced and positioned correctly still sold, while others simply took longer. That’s what a healthier market looks like.”

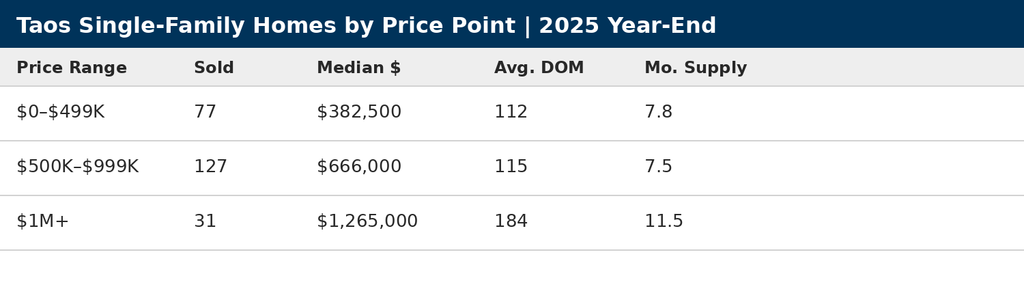

Single-Family Homes by Price Point

Single-family home performance in 2025 varied meaningfully by price point. Homes priced below $1M accounted for most sales and showed similar months of supply, pointing to steady demand across the core of the market.

The overall median price for Taos increased more sharply year over year, but that headline figure was influenced by a higher share of $1M+ sales in 2025. When looking only at homes under $1M, where most transactions occurred, prices still rose, but at a more measured pace. The under-$1M median price increased about 3.4% year over year, reflecting modest, steady appreciation rather than across-the-board price growth.

Homes priced at $1M and above continued to behave differently, with fewer transactions, longer timelines, and higher months of supply, reinforcing that buyer leverage increases as prices rise.

John’s Take

“Most of the market’s momentum in 2025 lived below $1M, where demand was broader and price changes were usually modest. Increased activity at the high end helped lift the overall median price, but that strength wasn’t evenly felt across the rest of the market. Above $1M, patience and realistic expectations mattered more than ever.”

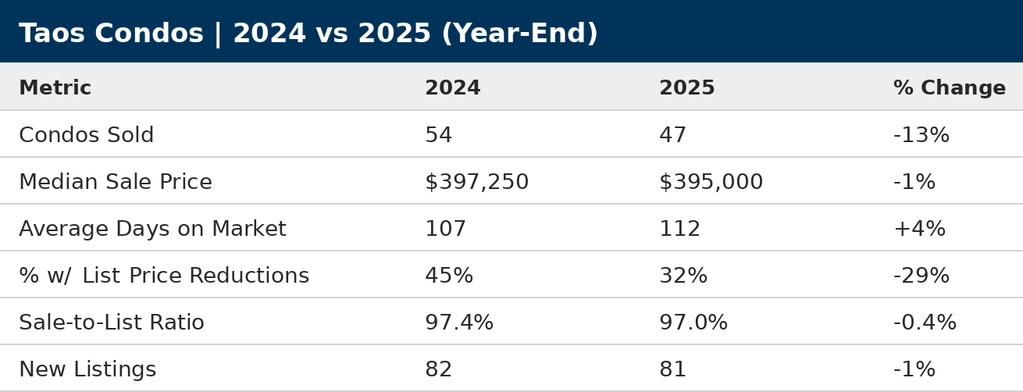

Condos: 2024 vs 2025

Condo activity softened slightly in 2025, with fewer sales and a modest increase in days on market compared to 2024. Median sale prices remained essentially flat, indicating that slower activity reflected buyer selectivity rather than declining values.

One notable shift was a drop in the share of condos with list price reductions. Fewer sellers adjusted pricing in 2025, suggesting better initial positioning or greater willingness to wait for the right buyer.

Overall, the condo market in 2025 was defined by steadier pricing, slower absorption, and increased buyer choice, rather than price pressure.

John’s Take

“Condo median prices stayed stable in 2025. Buyers had more options and time, and sellers who priced correctly upfront were rewarded. This is a market that favors patience and realistic expectations, not urgency.”

A Brief Look at Land

Land continues to operate under very different dynamics than homes.

With significantly more inventory than active demand, land remains firmly a buyer’s market. Well-located parcels with utilities, access, or unique characteristics like water rights still draw interest, but generic or over-priced lots often take considerable time to sell.

John’s Take

"Land can sell, but expectations need to be realistic. In today’s environment, patience and pricing discipline matter more than ever. Sellers who understand that tend to fare better than those anchored to peak-market assumptions."

Pricing Strategy & Negotiation

One of the clearest lessons from 2025 shows up in pricing behavior.

The listings that struggled most were typically those that launched well above where the market ultimately supported, sat without traction, and then chased the price down over time. That approach often leads to a worse outcome than pricing correctly from the start.

In a market like Taos, buyers pay close attention to how long a property has been available. Once a home feels market-worn, it invites tougher questions, stronger negotiation, and less urgency. The first pricing decision matters more than any price adjustment that follows, because you don’t get a reset on buyer perception.

John’s Take

"Overpricing doesn’t protect value. In most cases, it does the opposite. Homes that enter the market aligned with reality tend to generate better interest and cleaner negotiations than those that try to “test” the market first."

2026 Outlook

As we move into 2026, expect more continuity than disruption.

Mortgage rates will continue to make headlines, but in a second-home market like Taos, rates matter less than they do in primary home markets. Many buyers here are paying cash or reallocating equity from elsewhere, so modest rate changes don’t drive decisions the way they do in metro areas.

The bigger drivers remain local: inventory levels, buyer expectations, and how well a property is prepared and priced.

John’s Take

"Bottom line: it’s local supply and demand, not rates, that’s having the biggest impact right now. Homes that are turn-key and priced with intention should continue to perform. Those that aren’t will likely need more time, more flexibility, or both."

What Does This Mean for You?

For Sellers:

Price right the first time, or risk chasing the market down.

Presentation matters more than it has in years.

Work with someone who understands this market deeply and is willing to be honest about pricing and expectations.

For Buyers:

You have more leverage than you did recently, especially in single-family homes and land.

Condos offer good options, but the best units are still moving when they’re priced and prepared correctly.

Even when there isn’t an obvious price reduction, there’s often room to negotiate.

For the Curious:

Every neighborhood, price range, and property type is behaving differently.

National headlines don’t tell the full story here. Local context matters, and broad averages can be misleading.

Final Thoughts

Whether you’re considering selling, buying, or just keeping an eye on the Taos real estate market, understanding these nuances matters. If you want to talk through how these trends apply to a specific property or neighborhood, that conversation is always more useful than relying on broad averages.

If you’d like help interpreting what this means for your situation, feel free to reach out.

All data from the ECAR MLS. Report compiled and interpreted by John Cornish, your honest local Taos Realtor.