By John Cornish, Taos Realtor®

Looking for the most current data?

This report captures where the Taos market stood at mid-year. For full-year results and what they suggest for 2026, see the 2025 Year-End Market Report + 2026 Outlook.

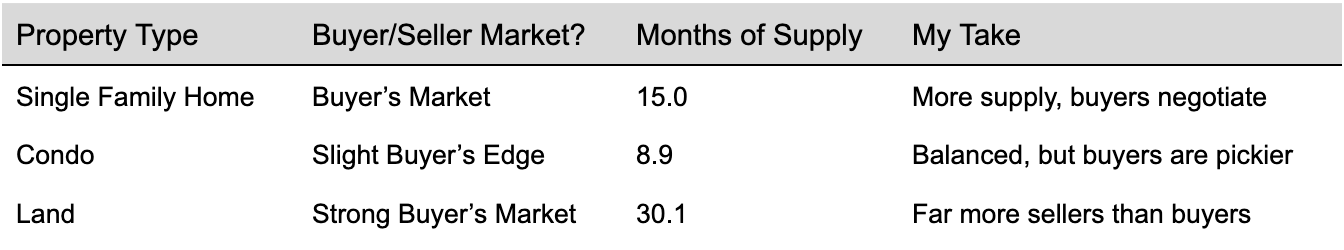

Market at a Glance (Q1 & Q2 2025)

(6 months of supply = balanced market; above 6 is buyer’s, below is seller’s)

A Quick Note on Interest Rates

My clients are always asking me about interest rates. Here’s my answer:

Rates are holding steady right now and aren’t swinging the market much either way. We’re not seeing a big rush of buyers when rates dip, or a freeze when they tick up.

The truth is, in a second-home market like Taos, rates matter less than they do in primary home markets. Many buyers here are paying cash or moving money from elsewhere, so small rate changes just don’t move the needle the way they do in metro or suburban areas.

Bottom line: It’s local supply and demand, not rates, that’s having the biggest impact on prices and activity right now.

Let’s Talk About the Real Market

Every summer, I take a hard look at the numbers and what’s actually happening in Taos. This isn’t marketing spin, national news, or cherry-picked stats; it’s the real story, drawn from our MLS and my day-to-day experience in this unique market.

If you’re thinking about buying, selling, or just watching the market, here’s my take. Let’s get to the point.

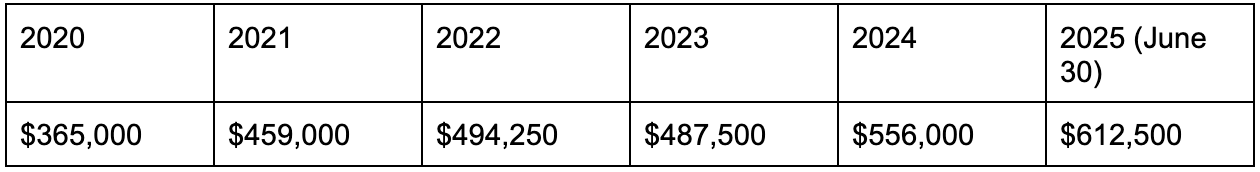

History of Home Prices in Taos

2020 to 2025 Median Price (Single Family Home)

First off, congratulations if you’ve owned a home in Taos over the past five years, you’ve seen some serious equity gains. While the overall price trend is still moving up in 2025, we’re starting to notice a bit of softening.

Here’s what the numbers show so far this year for single-family homes:

- Q1 Median Sale Price: $615,000

- Q2 Median Sale Price: $608,750

That means the median sale price dipped slightly from Q1 to Q2 (down $6,250, or about 1%).

It’s too early to call this a lasting trend, but it’s worth watching. Typically, when supply grows and buyer demand eases, we see some downward pressure on prices. I’ll keep an eye on the data and let you know if this is the start of something bigger or just a temporary blip.

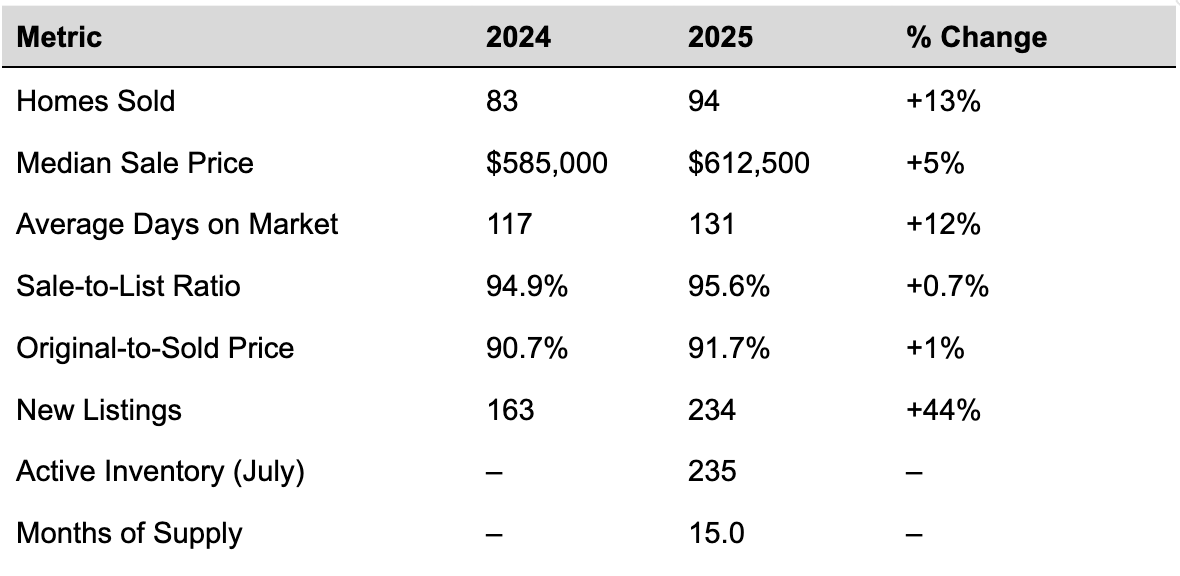

Single Family Homes: The Leverage Has Shifted

(Data Range: Jan 1 to Jun 30)

John’s Take:

- New Listings are way up. More options for buyers, more competition for sellers.

- Most homes are selling below asking. Only 14 out of 94 homes this year sold for full price or above.

- Sellers are chasing buyers. If you price too high, buyers will simply wait for you to drop or move on to a different home.

Is it a buyer’s or seller’s market? Very much a buyer’s market.

With 15 months of supply, buyers have the power. If you’re selling, expect buyers to negotiate hard. Price cuts, longer time on market, and lower offers are the rule, not the exception.

By Price Point (Q1 & Q2 2025):

How to read it:

Months of supply means how long it would take to sell everything in that price range at the current sales pace, if nothing new was listed.

Anything over 6 months is considered a buyer’s market, the higher the number, the more leverage buyers have.

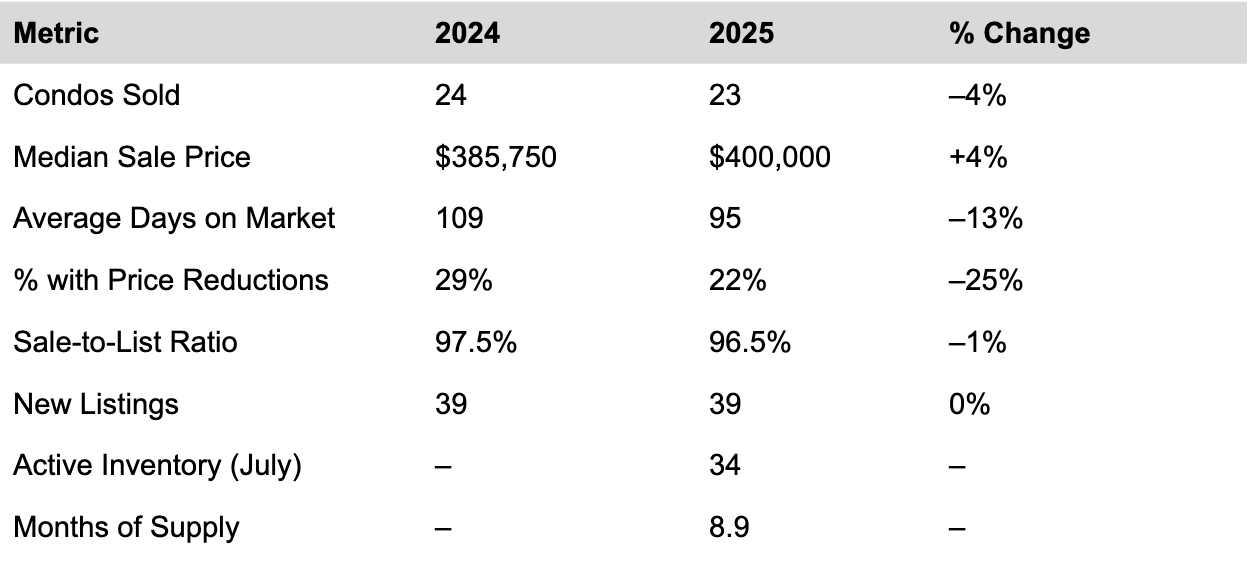

Condos: A Smoother Ride, But Still Leans Buyer

Click to Enlarge | Condo market holds steady in Taos—with limited supply and moderate buyer leverage.

John’s Take:

- Condos are selling faster and with fewer price cuts. Only about 1 in 5 sellers needed a reduction.

- Sale-to-list ratio is strong. Condos are selling for about 96.5% of their asking price, a smaller gap than homes.

- If you’re buying, you can still negotiate.

- If you’re selling, you have a good shot if your unit stands out.

Is it a buyer’s or seller’s market? Still a buyer’s market, but closer to balanced.

At just under 9 months of supply, buyers have a slight edge, but if your condo is priced right and shows well, it still sells quickly.

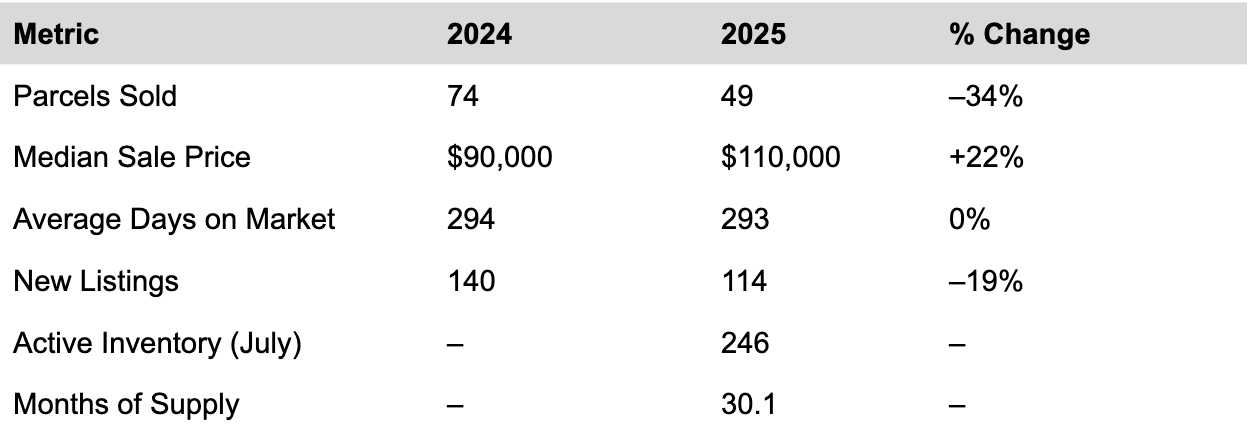

Land: Classic Buyer’s Market

John’s Take:

- Fewer land sales, more land for sale. Buyers can pick and choose, and they’re rarely paying full price.

- Sellers: If you’re not the best-priced lot, you could wait a long time.

- Buyers: Take your time, do your research, and negotiate.

Is it a buyer’s or seller’s market? It’s a buyer’s market, no question.

With over 30 months of supply, landowners have to be aggressive with pricing and patient with their timelines.

Original-to-Sold Price and Price Reductions

- Original-to-Sold Price shows how much homes (or condos/land) are actually selling for, compared to the asking price.

- In Taos single-family homes, the average is 91.7%, so if your original list price is $600,000, expect a sale around $550,200.

- In Taos single-family homes, the average is 91.7%, so if your original list price is $600,000, expect a sale around $550,200.

- Price reductions are common, but even homes that never officially drop the price usually end up selling below ask.

- So far in 2025, only 1 in 7 homes sold at the full asking price or above.

If you’re selling: You will be negotiating, whether that’s a public price cut or simply accepting an offer below ask.

What Does This Mean for You?

For Sellers:

- Price right the first time, or chase the market down.

- Presentation matters more than ever.

- Work with an agent who knows this market inside and out (and tells you the truth).

For Buyers:

- You have leverage, especially in homes and land.

- Condos give you options, but the best units still move fast.

- Even if there’s no official price reduction, expect room to negotiate.

For the Curious:

- Every neighborhood and price range is different.

- Don’t make big decisions based on national headlines, get a local, honest perspective.

Final Thoughts from John

This isn’t a market where everyone wins, but it’s a market where knowledge and strategy make all the difference.

I’m always available to answer questions, share honest advice, or give you a tailored market update for your situation, no pressure, just facts.

Text, call, or email anytime. Let’s make sense of these numbers together.

All data from the ECAR MLS. Report compiled and interpreted by John Cornish, your honest local Taos Realtor.